Table Of Contents

- How To Get A Startup Business Loan With No Money?

- How To Get A Startup Business Loan With No Money? - Steps to Follow

- 1. Evaluate All Of Your Assets

- 2. Know The Requirements Of The Lender

- 3. Decide If You Will Be Able To Repay The Loan

- 4. Understand Your Risks

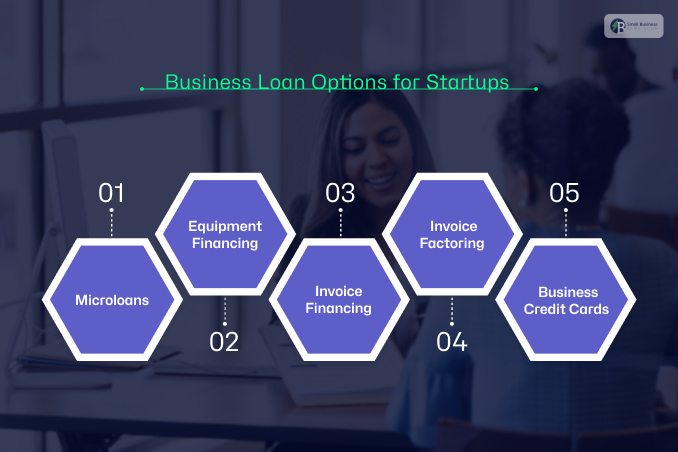

- Business Loan Options for Startups

- 1. Microloans

- 2. Equipment Financing

- 3. Invoice Financing

- 4. Invoice Factoring

- 5. Business Credit Cards

- Alternatives Of Getting A Startup Business Loan With No Money

- 1. Equity Financing

- 2. Crowdfunding

- 3. Business Grants

- The Bottom Line

How To Get A Startup Business Loan With No Money? – Steps to Follow

Last Updated on: November 20th, 2024

How to get a startup business loan with no money? Well, getting on board with our own start-up is a dream of many people. However, not everyone is able to achieve it. While it may seem very amusing to have a startup of your own, it is not as fun as it looks like. There are a number of complications that one has to deal with in order to run a successful startup business.

In this article, you will learn about how to get a startup business loan with no money. Here, you will learn the major steps to secure a startup loan. Moreover, you will also learn about a few alternatives to how to get a loan to start a business. Hence, to learn more, read on to the end of the article.

How To Get A Startup Business Loan With No Money?

The major issue that people face while opening a startup is the lack of financing. Many ideas have gone to waste because of the lack of money.

Even if you wish to apply for a loan, you need to make sure that you have enough money for the approval of the loan. Now, the issue is, what if you have no money at all? Like being a teenager, if you wish to open a startup business, it would not be a surprise if there was no money in your bank account.

So, does that mean you cannot get the loan you have been longing for? Well, not necessarily. There is, in fact, a solution for this. So, without any more delay, let us get ahead with this.

Can you get a startup loan with no money in your bank?

Well, it is, in fact, possible for you to get a startup business loan with no profits, revenue, assets, or cash flow in hand. However, because you can get a small business loan with no money, it does not mean that it is the best option.

If there is a chance that you can wait till your business becomes profitable, do it. This way, you may be able to get your hands on better funding alternatives that have better repayment terms and way more attractive interest rates.

How To Get A Startup Business Loan With No Money? – Steps to Follow

If you do not have enough money in your pockets or enough revenue in your business, you would have to prove to any potential lender that you would be able to repay the loan in some other way.

Here is what you may tell the lender to get financing for your business:

1. Evaluate All Of Your Assets

Every time a lender allows for a loan, they do it at risk. They need to be completely sure that the borrower will be able to repay them the money in full. Lenders get to determine this by seeing if you are generating any revenue through your business.

If you are not doing so, you need to consider all the other positive attributes that you may offer to the lender. For instance, the business’s assets can be good collateral. Even your personal credit history may make you look like a safe bet.

2. Know The Requirements Of The Lender

There are certain lenders who need the borrowers to at least have a specific amount of money in their bank account before even considering extending their loans.

However, there are some lenders who are more casual about cash flow than others. This is only applicable when you have a solid credit history or meet the other requirements of the business for the loan. Therefore, you need to know what the lenders are actually looking for.

3. Decide If You Will Be Able To Repay The Loan

If you are ever getting a business loan, you would have to cover the payment of the loan, along with the everyday expenses of the business. The payment of the loan would depend on the funding amount, the repayment term, and the interest rate.

There are some lenders who may even offer you monthly payments. But in most cases, startup business loans require daily or weekly payments. If you cannot afford the potential loan payments, it is better to stay away from a loan. You may then look out for other funding options for your business.

4. Understand Your Risks

Loan terms are a reflection of risks. If the loan appears to be risky, it will have a higher payment frequency and interest rate and a shorter payment period.

If you do not feel confident enough to repay the loan without money in your bank, there is no point in even applying for this loan. You would have to be in more debt to come out from one. Breaking out of this cycle may become even more difficult.

Business Loan Options for Startups

If you are unsure about how to get a startup business loan with no money, here are some options you can consider:

1. Microloans

As the name suggests, microloans have a small limit for startups (generally ranging up to $50K). In fact, most lenders that issue these loans are non-profit organizations. In this case, you will also get the advantage of flexible qualification requirements.

2. Equipment Financing

In equipment financing, the underwriting process is somewhat different than that of a traditional loan. Here, the lender funds 100% of the purchase, and the equipment that you buy acts as collateral for the loan. However, the terms of the loan depend on credit, time in business, and the need for the equipment.

3. Invoice Financing

If there are unpaid invoices in your business, they act as collateral in case of invoice financing. In exchange, the financing company will give you a percentage of your unpaid invoices. However, the focus is mainly on the value of your invoice. Hence, it is a good option if you have a limited cash flow.

4. Invoice Factoring

It is quite similar to invoice financing. However, it uses unpaid customer invoices to provide capital for your business. Here, you sell those customer invoices to a third-party factoring company. Then, the factoring company collects payment from your defaulter customers and offers funding to your business.

5. Business Credit Cards

A business credit card can boost your credit score if you are starting out with your startup. Once you boost your credit score, it will help your business secure loans faster in the future. However, to secure this financing option, make sure you have good personal credit.

Alternatives Of Getting A Startup Business Loan With No Money

As I mentioned, there is no reason for you to apply for a loan if you are not confident enough about it. There are other alternatives that are better options when it comes to funding your business. Let us go through some of these alternatives and see if they are a better option for your startup business.

1. Equity Financing

You may use equity financing to raise funds by selling the shares or stakes in your business. This is a good option if you are unable to find good loaning options for your startup business.

While there is no loan debt that you would have to deal with in this option, the shareholders would have their share in the ownership of the business.

2. Crowdfunding

If you have just launched your business, crowdfunding is a good idea. It comes with zero debts and allows others to invest in your idea. Not only will it help you fund the new business, but it also may increase the awareness of your brand.

3. Business Grants

If your business is well established but does not generate proper revenue, you may go for a small business grant. Not every business will be able to meet eligibility requirements. Also, the competition is extreme when it comes to these types of grants, but there is funding available.

The Bottom Line

I am hoping you have understood how to get a startup business loan with no money. While it is an available option, it is not the most preferable option for you to pick. Moreover, there are a number of complications that you would have to deal with if you are getting a loan with no money in the bank.

Do you have more suggestions on how to get a startup business loan with no money? Please share your ideas and opinions in the comments section below.

Continue Reading:

All Comments

Restore CBD Gummies Price

30th December, 2023

Wonderful web site Lots of useful info here Im sending it to a few friends ans additionally sharing in delicious And obviously thanks to your effort