Table Of Contents

Small Business Taxes For Beginners: Here Are A Few Tips And Best Practices To Follow

Last Updated on: November 7th, 2024

Are you worried about small business taxes for beginners?

For most companies, tax returns are due by April 15th of the fiscal year. If you can’t file your papers by then, you’ll need to request an extension. Requesting an extension is an easy process and only takes a few minutes.

Once approved, you’ll have until mid-October to complete filing your taxes. However, that doesn’t mean you can wait until October to make payments. It’s still your responsibility to pay by the due date on your return to avoid any late fees.

What other tips could help with preparing business taxes? Read on to find out!

Preparing Small Business Taxes For Beginners

As you begin preparing business taxes, you’ll need to calculate your company’s profit or loss. You’ll be including all of this financial information on each tax return form.

As a sole proprietorship or single LLC member, you’ll need to fill out a Schedule C form. You can check out this guide if you think you need to change your company’s entity but aren’t sure. Along with the Schedule C form, you’ll also need to complete a 1040 form.

The Schedule C form is a way of accounting for all of your company’s income. The 1040 form helps establish your entire income. Then, the IRS can compare these numbers to determine what you owe.

Small Business Taxes For Beginners: How To Make Tax Payments Easier?

As a small business owner, you do not need to consider your tax time as a headache. Basically, you can use a wide variety of royals and resources if you want to make your tax payments easier. Furthermore, with the help of pro tips, you can also organize and prepare your business taxes better.

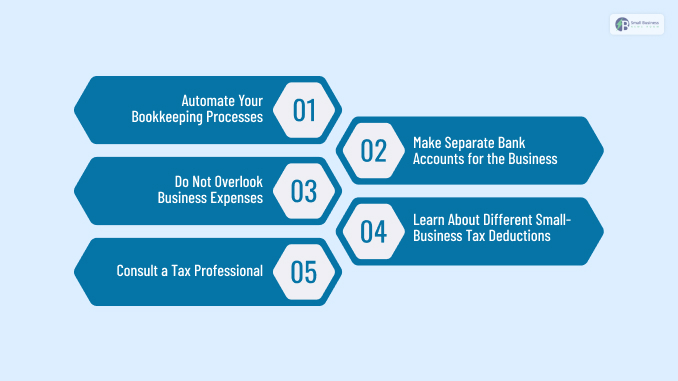

The following are some of the major tips with the help of which you can manage your taxes and finances better:

1. Automate Your Bookkeeping Processes

If you want efficient, accurate, and actionable financial insights, you need to automate your bookkeeping processes. For example, you can use software systems like QuickBooks, FreshBooks, etc.

By automating bookkeeping, you can directly direct important transactions from your bank account, cards, and other sources. This way, you can save a lot of time. Apart from that, you can also save money by hiring additional people in your business. Additionally, you can reduce human error, which is common in bookkeeping.

2. Make Separate Bank Accounts For The Business

Sometimes, you can mix up business and personal expenses. Hence, it is always a better practice to maintain a separate bank account for your business. This will ensure that you can claim legitimate deductions on your tax return. As a result, you can support your claims during an audit.

Furthermore, once you separate your personal finances and your business finances, you can get a clearer picture of the cash flow of the company. Apart from that, you can also get better protection, which also helps during lawsuits. Separating the two accounts also helps when your business is in need of a loan.

3. Do Not Overlook Business Expenses

It is common among businesses to report half of the expenses to which they are entitled. This happens when they overlook the importance of detailed receipt management. As a result, they end up with tax deductions. Otherwise, these businesses could funnel back the money to grow their business.

4. Learn About Different Small-Business Tax Deductions

Generally, new owners are not aware of the small business tax deductions. No matter what structure your business has, you are actually eligible for a wide range of deductions. For example, you can get tax deductions for startup and organizational expenses through the years.

This happens due to amortization. Apart from that, there are also tax deductions for inventory-based businesses and various utilities that you use for your business.

5. Consult A Tax Professional

One of the major advantages of using a tax professional is that they have the experience and knowledge of dealing with tax changes and regulations. As a result, they will be able to inform you what steps to take to update your business processes. Furthermore, there shall be minimal errors in your tax-related aspects.

What About Self-Employment Taxes?

As a small business owner, you’ll also be responsible for paying self-employment taxes. Social Security and Medicare are two types of self-employment taxes. You’ll be paying these taxes using your business’s net income or profit.

If you don’t have any income from your company during the first year, you can skip paying the self-employment tax. If your income during the first year is $400 or lower, you can also skip paying the self-employment tax.

Self Employment Equation

It’s helpful if you understand the calculations that go behind coming up with the self-employment tax number. First, you’ll need your entire business’s net income.

Multiply the net income by “0.9235” and multiply that number by 15.3% (the federal self-employment tax rate). The sum will give you a firm idea of what your tax liability will be for self-employment.

When To Hire An Accountant

As tax day comes closer, you might decide to hire an accountant to make life easier. We suggest hiring an accounting firm or using a tax preparation outsourcing company. Make sure the third party you hire has experience and a solid reputation.

Find out precisely what services the third party offers, and see if they cater to small businesses. Throughout the year, you and your finance team can work together to track your company’s income and spending.

If there’s a cash flow problem, you’ll be able to notice it more quickly. As you monitor your gross and net profits, it’ll become easier to prepare for tax day.

It’s also helpful if you outsource to a third party that uses an online platform. Both you and the third party can access the online platform so that you can get real-time information on your finances.

Writing Off Startup Expenses

You might be eager to write off all your startup expenses at the very beginning. However, this could wind up causing you problems down the road. When you’re launching a new business, tracking every penny you spend throughout the year is expected.

However, the IRS has specific limitations set up for initial startup cost deductions. To get into the specifics, you’ll need to reference IRS publication 535, chapters 7 and 8. The loss dictates that you can only deduct up to $5,000 during your first year of business.

Everything beyond the $5,000 limit has to be listed over 180 months. Don’t try to play with the IRS rules to maximize your deductions.

Instead, focus on writing off the entire $5,000, if that’s possible. Then, reach out to an accountant and ask them to help you spread out the rest of your expenses.

What About Car Deductions?

It can be confusing to understand the rules surrounding mileage deductions. If you’re driving your vehicle for business purposes, you could qualify for a car deduction. However, you’ll need to be able to prove that business driving was taking place.

Business driving could include traveling to see a client or even going on a business trip. However, business mileage doesn’t have the commute from your home to your work office.

Instead, the gas money you spend to get to the office is considered a nondeductible personal cost. In addition to claiming mileage, you should also deduct other costs of the vehicle. For a company car, you can remove the oil, gas, tires, insurance, parking fees, tolls, and even the lease payments.

Small Business Taxes For Beginners: Software Tax Tips

It’s clear to see that you won’t be able to have a successful tax day if you’re not keeping track of your expenses throughout the year. However, instead of relying on old record-keeping methods, we suggest investing in accounting software.

You can buy out-of-the-box software that doesn’t require extensive upgrades or customizations.

As your business begins to grow, you can start to implement the different plugins that you need, as time passes by.

There are a lot of other accounting software companies out there. When looking for the right software company to meet your needs, look at the ease of use, integration, and scalability.

If the software is challenging to use from the start, it’s not the right one for you. Instead, you should invest in user-friendly software that has all the features you need to make record-keeping simple.

Finally, scalability is the option to increase the software’s function over time. Name brand accounting software understands that businesses intend to grow. The software should use a cloud-based approach so that as your needs grow, you’ll have plenty of space.

Worry-Free Tax Preparation

Small business taxes for beginners don’t have to be stressful. As long as you’re keeping thorough records of everything you spend and buy, filling out tax forms can be easy. If your accounting needs are a bit complex, reach out to a third-party accounting firm or tax preparation firm.

Now is also an excellent time to decide whether you want to continue moving forward as a sole proprietorship or transition into a single-member LLC. Decide what entity makes the most sense for your company, and begin filling out the appropriate paperwork. For more tips like these, explore the rest of our website.

Read Also: