Table Of Contents

Double Declining Balance Method: A Comprehensive Guide

Last Updated on: June 17th, 2023

Calculating the expenses of maintaining an asset after purchasing it for the long run is essential for calculating future costs. If the costs are a lot, then purchasing that asset for the long run might not be a profitable choice. Therefore, for making business decisions related to assets, understanding the Double Declining Balance Method is crucial.

This calculation is essential for assets that depreciate at a fast pace, especially in the earlier years. These assets start depreciating slowly later on.

Therefore, to calculate the depreciation of such assets, you must use this calculation. Read this post till the end to learn how to do so.

What Does The Double Declining Balance Method Mean?

The double declining balance method, also termed the reducing balance method, is used by modern businesses for calculating asset expenses. This technique for calculating depreciation is known as accelerated depreciation since it calculates costs much faster than other methods.

If you are an entrepreneur, you must learn how to calculate an asset’s accumulated depreciation over time. It’s essential to do so because all your machinery and equipment have an expected production lifetime. As it depreciates due to wear and tear every year, its production capacity also decreases. Therefore, it’s essential for you to know these values for calculating your business’s net operating income.

Various Declining Balance Methods

There are various depreciation calculations apart from the double declining balance method that’s used by businesses for calculating asset depreciation. The other methods that businesses often use are:

1. Straight Line Depreciation

This Double Declining Balance Method helps in calculating asset depreciation from its initial purchasing price. This calculator is based on the salvage value of the asset – the value of the asset over its useful period.

Here’s the formula for calculating straight line depreciation or annual depreciation:

Annual Depreciation = Total Depreciation Amount (Purchase Price – Salvage Value) / Estimated Asset Lifetime

2. Sum-Of-The-Years Digits Depreciation

Whenever you buy a new asset for your business, it’s typically estimated to be useful for five years. Therefore, when you calculate the sum-of-the-years depreciation, you use the number of valuable years left in using the asset. You calculate this by:

Depreciation Balance = (Valuable Years Left / Annual Value) x Asset’s Remaining Depreciable Value

3. Units Of Production Depreciation

If you purchased new machinery for your business, depreciation is calculated by considering its useful life and its expected production.

First, calculate the expected production of a new machine by multiplying its per-unit depreciation with the total units produced. In addition, a portion of the total depreciation is fixed with each produced item using this specific machine. This is similar to calculating marginal analysis.

Double Declining Balance Method Formula

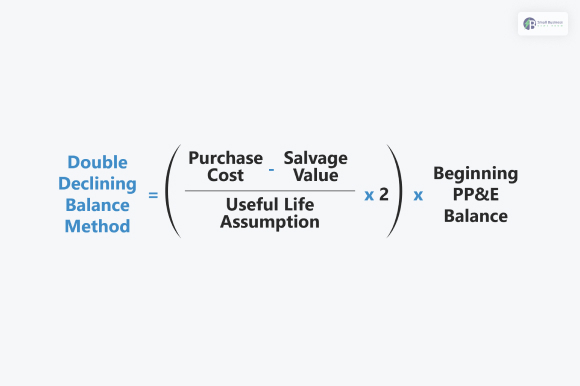

To calculate depreciation using the double declining balance method, you must learn its formula first. Therefore, here’s the double declining balance method formula:

(Asset Cost / Useful Asset Life) x (Book Value At the start of the fiscal year x2)

This formula will be used to calculate asset depreciation on an annual basis. However, this calculation concludes at the second last year of the asset’s useful life. When you calculate this depreciation value every year, it will show the difference between the asset’s book value at the start of the year and its ultimate salvageable value.

Double Declining Balance Method Calculation

Since the double declining balance method calculates depreciation at twice the rate of depreciation, it’s best used for quickly-depreciating assets. Since it’s not easy to calculate this depreciation value, it’s best done using various accounting software for businesses. It’s recommended to do so since it’s easier to track the depreciation value manually this way.

However, if you wish to calculate depreciation value using this method, here’s what you need to do:

1. Determine All Costs

Your first step here is to calculate all expenses associated with the purchase of the asset. This includes various types of costs like:

- Purchasing cost

- Legal charges

- Broker fees

- Closing costs

2. Calculate The Useful Life Of The Asset

Every asset that you buy for your business, especially machinery and other operations equipment, will have a fixed lifespan. Therefore, it will start to wear down and depreciate over time.

While it’s difficult to calculate how long an asset will last due to production changes, there are some standard values. These set values are considered the lifetime value of an asset, which is suggested by the IRS (Internal Revenue Service).

If you wish to have a look at this list, simply click on this link.

3. Identify The Asset’s Salvage Value

Your next step for calculating the double declining balance method is to find out the salvage value of your assets.

This salvage value is defined as the selling value of an asset at the end of its useful life. Therefore, if you wish to sell the asset after using it through its valuable years, this is the price you will be getting.

The salvage value of an asset also follows a standard rule, which is again determined by the IRS. Click this link to learn more about it.

4. Calculate The First Year Of Depreciation

Now that you have learned the values above, it’s time to use the double declining depreciation formula. All you need to do is calculate the depreciation for the first year.

5. Continue Calculating Depreciation

Now, all you need to do is follow the double declining balance method to calculate the depreciation and final value of an asset over the years. You will do so as long as it reaches its final valuable year and becomes the same as the salvage value.

Conclusion: Learn How Much To Salvage After How Many Years!

Understanding the double declining balance method for depreciating assets is essential to understand how much the value of an asset depreciates. Every asset, like machinery that you purchase for your business, has a fixed valuable life or useful life where its productivity is at its most.

At the end of its useful life, you can sell it off at a price. However, you can calculate its salvage price before it by calculating its depreciation every year using the double declining balance depreciation method.

If you have any queries, you can comment down below, and I will reach out to you soon!

Explore More: