Table Of Contents

- Loan Approval: A General Overview

- Signs Your Loan Will be Approved: Factors to Consider

- 1. Credit Score and Loan History

- 2. Debt-to-Income Ratio

- 3. Stability of Income

- 4. Loan Amount and Purpose

- Checking For Signs Your Loan Will Be Approved

- 1. Your Credit Score is High

- 2. You Have a Stable Source of Income

- 3. Your Debt-to-Income Ratio Is Low

- Understanding Loan Approval

Loan Approval 101: Signs Your Loan Will Be Approved

Last Updated on: November 13th, 2024

When you apply for a startup business loan or a personal loan, you must ensure that the lender approves your loan quickly. However, to do this, you need to learn important signs your loan will be approved.

This will give you a better idea of how to rightfully apply for the loan and secure the loan in one go.

In this article, you will learn about major signs of loan approval. Firstly, you will understand how loan approval works. Then, this article will guide you in exploring major factors that impact the loan approval process.

Finally, you will learn how to check for loan approval signs. Hence, to learn more, read on to the end of the article.

Loan Approval: A General Overview

Generally, you borrow a loan for your startup from a financial institution like a bank, online lender, credit union, etc. Depending on the type of small business loan you apply for, there are different eligibility criteria you need to follow.

Also, the type of loan you get determines whether you can use the loan for different purposes.

However, before applying for a loan, you must ask, ?Is a small business loan secured or unsecured?? For example, business loans are generally secured, and personal loans are unsecure. However, there are always exceptions present regarding loans.

When a loan is unsecured, actually it means that the borrower does not need to keep collateral with the lender. Also, the lender will not require the borrower to pledge assets to secure the loan.

Here, if the borrower shows creditworthiness and a good credit score, securing the loan will be easier. Basically, the lender will check whether your business can repay the loan.

On the other hand, with a secure loan, you will need to keep collateral with the lender. This offers security to the lender if you become a defaulter to the loan. Here, if you default on the loan, the lender can seize the collateral or sell it to cover loan expenses.

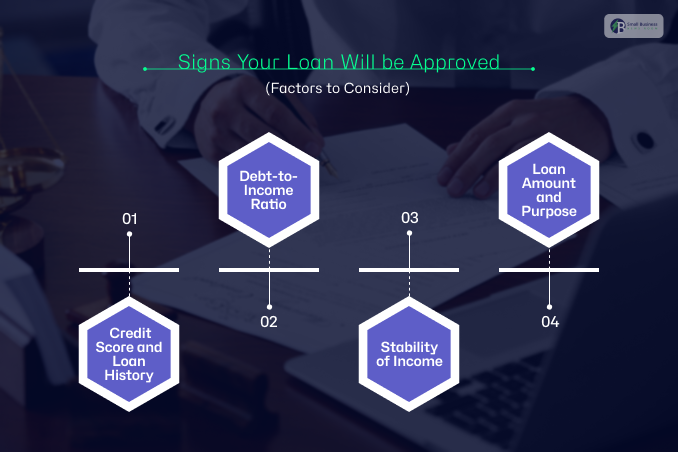

Signs Your Loan Will be Approved: Factors to Consider

There are a variety of factors that you need to consider if you want to look for signs of loan approval. This is because many aspects impact the lender’s approval decision.

In general, lenders need to evaluate different aspects of your financial situation. They do it to ensure you are eligible for the loan terms.

By understanding the factors that influence loan approval, you can better understand the complexities of the loan approval process.

The following are some of the major factors you need to consider ensuring that lenders will approve your loan application:

1. Credit Score and Loan History

The first thing that lenders check is your credit score and your loan history. Basically, this score is a numerical value of how creditworthy you are. This factor depends on your repayment history, credit utilization, credit length, and types of credit accounts.

For instance, if you have a credit score of more than 650, you have a higher chance of loan approval. In fact, having a higher credit score shows that lending to you is less risky. This is because you use your loans responsibly and repay your loans on time.

However, a low credit score means most lenders will reject your application. A credit score is low when a borrower fails to repay the loan on time.

Also, when debt collectors like LVNV Funding LLC pursue an individual, the credit score has a negative impact. Moreover, your credit score shall be low if you have applied for SBA or EIDL Loan Forgiveness.

Remember, always reach out to reputable credit reporting agencies if you want to check your credit score. Moreover, it is also important to keep track of your credit score and credit report. Also, if you wish to any error or discrepancy, you must report that immediately.

2. Debt-to-Income Ratio

Your debt-to-income ratio is another important factor you need to consider for loan approval. Basically, this is a ratio of your monthly debt obligations to your monthly income. Hence, with the help of it, lenders get a better idea of your ability to manage more debt.

You can add up your monthly debt payments if you want to calculate your debt-to-income ratio. These include your loans, credit card bills, mortgages, etc. Then, take this total monthly debt payments and divide it by your monthly gross income. This will give you the value of your debt-to-income ratio.

In this case, if your debt-to-income ratio is low, which is around 35% or lower, then your lenders will prefer to offer you a loan. This is because your ratio indicates that you have the capacity to repay additional debts.

3. Stability of Income

All lenders want their borrowers to have a stable income. This helps the borrowers to make timely payments. For example, lenders check the borrower?s employment history, income stability, and income level with personal loans.

On the other hand, with business loans, lenders check years in business, income level, and income stability.

Obviously, if you (or your business) have a steady source of income, you will get the preference of your lender. This is because you can better meet your financial obligations and repay your loans.

Apart from that, your lenders can also consider your years of employment and years in business.

Hence, you must provide full and accurate employment and income information details. Also, ensure you provide information about your pay stubs, documents, and tax information. This will give you an idea of your income claims.

4. Loan Amount and Purpose

The amount and purpose of the loan you request heavily impacts the lender’s decision to approve it. For instance, above a certain limit, the lender might require you to provide information about how you will use the money you are borrowing.

Apart from that, some lenders will even restrict you regarding the way you want to use the loan. However, on the other hand, some lenders will offer you flexibility. Basically, you need to read the terms and conditions of the loan before you sign the application.

Hence, you need to ensure that your loan amount aligns well with the needs and purpose of your loan. Also, your need for the loan must fall under the lender?s lending guidelines.

Checking For Signs Your Loan Will Be Approved

Once you apply for a loan, looking for signs that your loan will be approved is okay. However, you must also understand that all lenders have their own criteria. Despite those differing criteria, you can get an understanding of signs that indicate a higher loan approval rate.

The following are the major signs that you need to check to ensure your loan will be approved:

1. Your Credit Score is High

The first thing that your lender checks when determining your eligibility is your credit score. Basically, the credit score shows your creditworthiness and gives an idea of your credit history.

If you have a good credit score, your likelihood of receiving a loan increase significantly. Generally, a good credit score is something between 600 and 850.

A good credit score shows that you have paid your credit before and on time. Also, it shows that you have responsible financial behavior. Hence, the possibility of loan approval increases.

2. You Have a Stable Source of Income

If you have a stable source of income, it will obviously be easier for you to repay your loan consistently. Hence, lenders try to approve applicants who have stable incomes. Thereby, the chances of loan approval increase significantly.

However, to check whether you have a stable income, lenders can ask for documentation, pay stubs, tax receipts, etc. Furthermore, if you are in business for a few years, you will find it easier to secure a loan.

The same applies to people with employment. If you have a stable employment history, you can get loans faster.

3. Your Debt-to-Income Ratio Is Low

Your monthly debt obligations need to be low. Then, you can think about repaying another debt. Lenders can find this with the help of the debt-to-income ratio.

Basically, a low debt-to-income ratio shows that your financial situation is healthy. Hence, you can manage your loan better and will be able to repay your loan.

Understanding Loan Approval

Understanding the important signs your loan will be approved will help you influence the approval process. Also, you can evaluate your financial solution better. This will enable you to take appropriate steps to improve your eligibility.

Also, you must monitor your credit score, manage your debt-to-income ratio, and maintain a stable income. This can significantly improve the chances of loan approval.

Furthermore, if you want help with the loan application and approval process, you can ask for help from a loan expert.

Do you have more information to add regarding signs of loan approval? Please share your ideas and opinions in the comments section below.

Read Also: